Flagstar 15 Year Mortgage Rates

Conventional 5 year adjustable mortgage rates today at flagstar bank are at 3 161 percent.

Flagstar 15 year mortgage rates. Maybe a rate for a 15 year loan or a 10 year loan. The apr calculation is based on a 30 year fixed rate mortgage in the amount of 240 000 for the purchase of a single family primary residence with 80 loan to value ltv or 20 down payment minimum borrower credit score of 740 and estimated points of 1 of the loan amount and origination fee of 1 295 with 360 monthly payments in the. Compare mortgage rates from multiple lenders in one place. Looking for a mortgage rate for a 30 year loan.

On monday october 05 2020 according to bankrate s latest survey of the nation s largest mortgage lenders the benchmark 15 year fixed mortgage rate is 2 560. It s fast free and anonymous. Current 15 year refinance rates. This is a great option for those who plan to stay in their homes for a long time.

On monday october 05 2020 according to bankrate s latest survey of the nation s largest refinance lenders the benchmark 15 year fixed refinance rate is 2. Use our mortgage calculator to get a customized estimate of your mortgage rate and monthly payment. 30 year fixed rate mortgage a longer fixed rate home loan tends to offer more financial flexibility for those with monthly budgets in mind. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

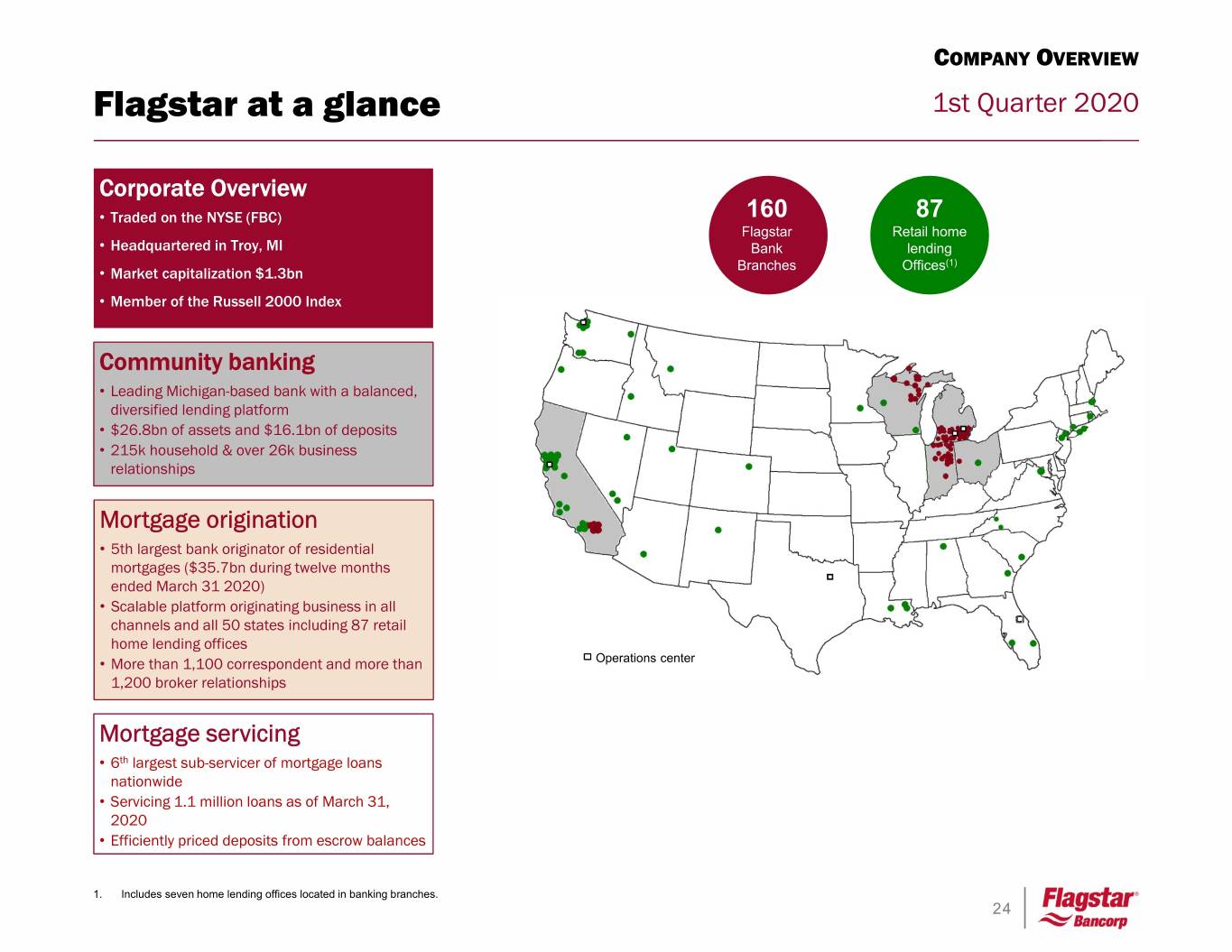

Whether you re comparing interest rates for the purchase of a home or considering refinancing an existing mortgage flagstar bank makes it fast and convenient to get the right solution for you. How to read our rates. To see our current mortgage rates for refinance go to mortgage refinance rates. Average 5 year adjustable mortgage rates current are about 40 basis points lower at 2 76.

While 15 year mortgage interest rates are not lower than the national average of 3 00 percent today the rate is better than what most lenders are offering right now. Mortgage rates valid as of 01 oct 2020 09 06 am cdt and assume borrower has excellent credit including a credit score of 740 or higher. Arm interest rates and payments are subject to increase after the initial fixed rate period 5 years for a 5 1 arm 7 years for a 7 1 arm and 10.